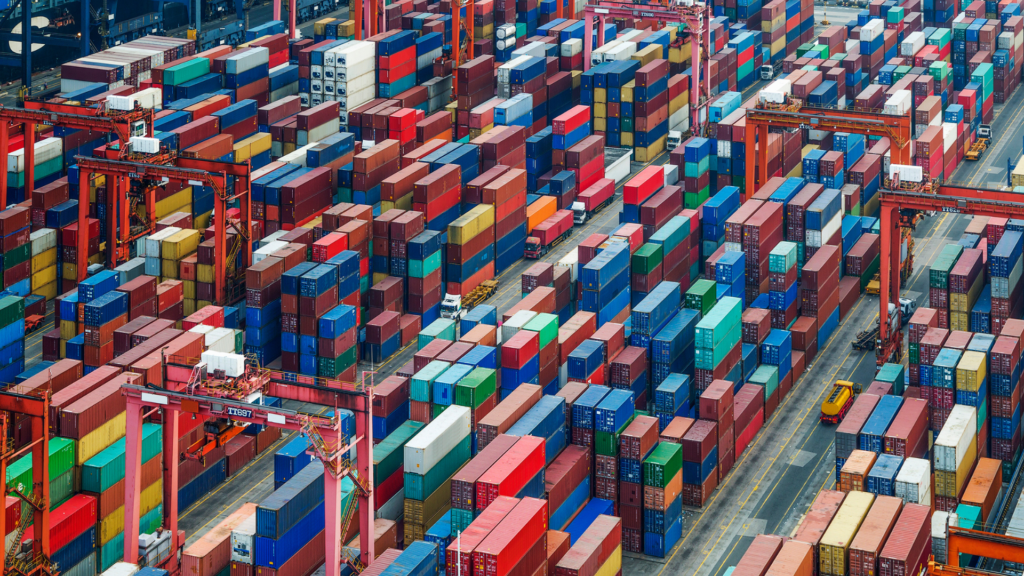

U.S. Imports: East-West Cargo Gap Widens in August

With U.S. port data from August trickling in, we’re getting greater insight into the West to East cargo shift that continues to play out in the United States.

A new report from industry veteran John McCown, founder of Blue Alpha Capital, does an excellent job at dissecting the August data from the top ten U.S. ports. The report shows that total inbound cargo volumes to the United States were flat in August (0.0%) compared to the same month last year. This compares to a 0.2% yoy decline in July and well below the 5.0% gain in June.

Considering forecasts had been calling for volumes to decline starting in August, flat performance is pretty good.

August’s overall inbound volume, at more than 2.1 million TEUs, was actually the fifth highest monthly volume ever and 4.8% above the average monthly volume since the summer of 2020 when the pandemic-fueled imports surge began.

East-West Cargo Gap

Perhaps the most striking takeaway from August was the difference in performance between East and Gulf Coast ports and those on the West Coast.

As we have reported recently, the East/Gulf Coast ports of New York/New Jersey, Savannah and Houston all recorded strong year-over-year gains in August, while Los Angeles and Long Beach on the West Coast reported falling volumes (Long Beach saw a slight increase in overall volumes due to empty exports, but imports were down yoy).

To further illustrate this shift, the Port of New York and New Jersey, which typically ranks as the third busiest U.S. port behind Los Angeles and Long Beach, reported the highest total throughput in the country in August.

McCown’s report shows inbound cargo volumes at East/Gulf Coast ports were up 17% compared to the average from the previous 26 months, while West Coast ports were 7.5% below. The coastal gap in August, at 23.5%, was the fifteenth straight month where the year over year percent changes in volume at East/Gulf Coast ports outperformed West Coast ports, and the second highest during that same period, according to McCown. The gap was primarily driven by a sharp drop in inbound volumes at Los Angeles and, to a lesser extent, Long Beach.

To put it simply, East and Gulf Coast ports are increasingly picking up volumes that West Coast ports are losing. And if you pull the charts back, you’ll see West Coast ports have been losing market share (as a % of the total inbound cargo) relatively consistently since 2016, coinciding with the opening of the expanded Panama Canal.

“Since mid-2021 there has been a more pronounced move away from the West Coast as shippers redirected container routings to minimize the effect of widely reported delays related to congestion. There has been some recovery from the December 2021 low point in the early part of 2022. However, the figures have returned to a downtrend since March and are now at record lows,” McCown writes.

Storm Surging

The ports of Tampa Bay and Jacksonville were closed to vessel and intermodal traffic Wednesday as Hurricane Ian approached the southwest coast of Florida. The Category 4 storm is expected to wreak havoc in the area.

As of Tuesday, Tampa and 18 other ports along the southwest coast were completely closed to ship movements by the US Coast Guard (USCG). All vessels over 500 tons have left the area ahead of the storm in Tampa. Meanwhile, the Jacksonville Port Authority stated that “there are no ‘safe havens’ identified for a vessel to safely survive,” so all ships lingering near the port or sitting on anchorage were evacuated.

Rail Rerouted

Delays are to be expected for rail traffic in and out of Florida. CSX closed its Central Florida intermodal terminals to all trains on Tuesday and its near-dock Tampa intermodal terminal was closed early Wednesday.

Although Northfolk Southern stated that its network will operate as scheduled, they’ve positioned generators and equipment in the event of network outages.

Florida East Coast Railway said Ian’s expected path “predicts impacts to multiple parts of FEC’s network starting early Wednesday morning in South and Central Florida.” Its Jacksonville ramp expects to move the last trains out of the region by Wednesday afternoon, with four other ramps also completely closed. But the short-line rail provider said it anticipates that the Jacksonville ramp will reopen Friday.

Winding Up

Things are looking good for wind-powered ship propulsion.

The latest installations of wind propulsion technology on large commercial vessels have tipped the amount of cargo that can be transported on vessels that make use of wind as a renewable energy source over the one million tonnes of deadweight (DWT) milestone.

This comes just as the industry celebrated World Maritime Day. The theme? "New Technologies for Greener Shipping." This milestone feels very appropriate for the occasion.

With the volatility of gas prices and the price of propulsion technology declining, the industry will likely see a major shift toward this fuel-efficient and eco-friendly option.