Labor Talks Ad Nauseum and Holiday Season Forecast.

Your weekly All-Ways round-up of supply chain news.

Devastating Damage

One worker is mad, and a whole port gets shut down for the day.

Sounds crazy? Maybe, but that’s the current reality.

The ripple effects of those single events are causing devastating damage far beyond the port.

While the West Coast longshore labor negotiations drag on with little progress, exporters are raising concerns about the impending losses.

A single walkout because of one unhappy worker can result in millions of dollars down the drain.

“This episode is infuriating,” said an agricultural exporter in a conversation with the Executive Director of the Agriculture Transportation Coalition, Peter Friedmann. “One person’s grievances cannot shut down multiple ports,” the anonymous source said. “The damage this guy caused just to a single ag exporter is unacceptable.”

“With almond and walnut prices falling, we missed LRDs [last receiving dates] and are falling out of contract,” the exporter added. “Clients are giving us problems and we are going to have to either cancel or give big discounts, which we cannot recover from the processors. And [we’re] just one small exporter. You don’t need to imagine the damage done across the board to exporters.”

Exponential Effects

Agricultural exporters are particularly concerned because of all the losses incurred during the 2014-2015 rounds of contract negotiations for dockworkers on the West Coast.

According to a Manhattan Institute report issued in April 2015 after an agreement had been reached, apples were left to rot in Washington warehouses, losing the industry $19 million per week. Shippers chose to ship via airfreight or to divert cargo to the East Coast ports resulting in more losses.

The North American Meat Institute said at the height of a major disruption back in February of 2015: “The cost to meat and poultry companies losing sales or facing unanticipated port charges is in excess of $40 million per week on top of initial losses which exceeded $50 million.”

The losses of a port shutdown go way beyond the terminals.

Obliterated Optimism

If it wasn’t apparent until now, longshore labor talks are a long way from the finish line. All remaining hope that an agreement will be reached in the near future has all but vanished.

Jurisdictional disputes between the ILWU and the National Association of Machinists have put coastwide negotiations between the PMA and ILWU on hold. The hearings have been temporarily adjourned while the PMA and ILWU are in discussion to return to big-table negotiations.

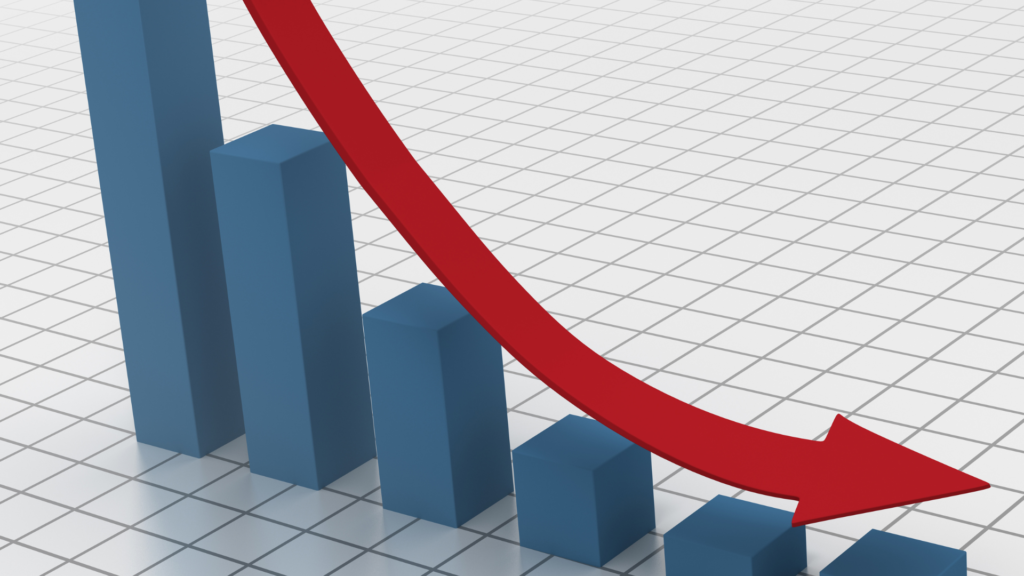

Slower Season

The next two months are expected to be busy for retailers because of the holiday season while imports to major ports in the US are on a steady decline.

“Cargo levels that historically peak in the fall peaked in the spring this year as retailers concerned about port congestion, port and rail labor negotiations and other supply chain issues stocked up far in advance of the holidays,” said Jonathan Gold, NRF Vice President for Supply Chain and Customs Policy. “With a rail strike possible this month, there are still challenges in the supply chain, but the majority of holiday merchandise is already on hand and retailers are well prepared to meet demand.”

“We expect the flattening of demand that began around the middle of this year to continue into the first half of 2023,” Hackett Associates Founder, Ben Hackett stated. “This will depress the volume of imports, which has already declined in recent months. Carriers have begun to pull services and are looking at laying up ships.”

The forecast for the remainder of the year is down 5.3% year over year, bringing the expected total volume to numbers nearly identical to 2021’s annual reports.