The Effects of Sections 232 and 301 and A Return To Normalcy in Container Shipping.

Your weekly All-Ways round-up of supply chain news.

Weight on Importers’ Shoulders

An independent, nonpartisan, fact-finding federal agency, the U.S. International Trade Commission (USITC) found that importers absorbed most of the costs caused by tariffs under sections 232 and 301. These actions affected certain steel and aluminum products beginning in March 2018 and thousands of products imported from China in July 2018.

Here are some of the effects on trade, production, and prices on industries:

➡️ Import prices increased at the same rate as tariffs causing importers to cover nearly the full cost of the tariffs.

➡️ Section 232 tariffs caused the volume of imported steel to decrease by 24%. Prices of steel in the USA increased by 2.4%. US production of steel products increased by 1.9% or $1.3 billion higher in 2021 because of the section 232 tariffs.

➡️ Import was reduced by 31% of aluminum products affected by section 232 tariffs. The price of aluminum products in the USA went up by 1.6% and the cost of US production of aluminum increased by 3.6% or $0.9 billion higher in 2021 because of the section 232 tariffs.

➡️ Domestic sourcing increased because of section 232. Because of increased prices, it reduced production in downstream industries in the USA that use steel and aluminum products, affecting each industry differently. On average, prices in downstream industries increased by 0.2% and decreased production by 0.6% or $3.5 billion less in 2021 because of section 232 tariffs.

➡️ Import from China was reduced by 13% across all affected sectors due to section 301 tariffs, upped the value of U.S. production by 0.4%, and increased the price of U.S. products by 0.2%.

➡️ The effects of section 301 varied in specific sectors. For computer equipment in the USA, for example, prices increased by 0.8% and the value of US production of computer equipment increased by 1.2 percent. Import of semiconductors decreased by 72.3% because of section 301 tariffs, increased the price of semiconductors in the US by 4.1%, and increased the value of US production of semiconductors by 6.4%.

Source: US International Trade Commission

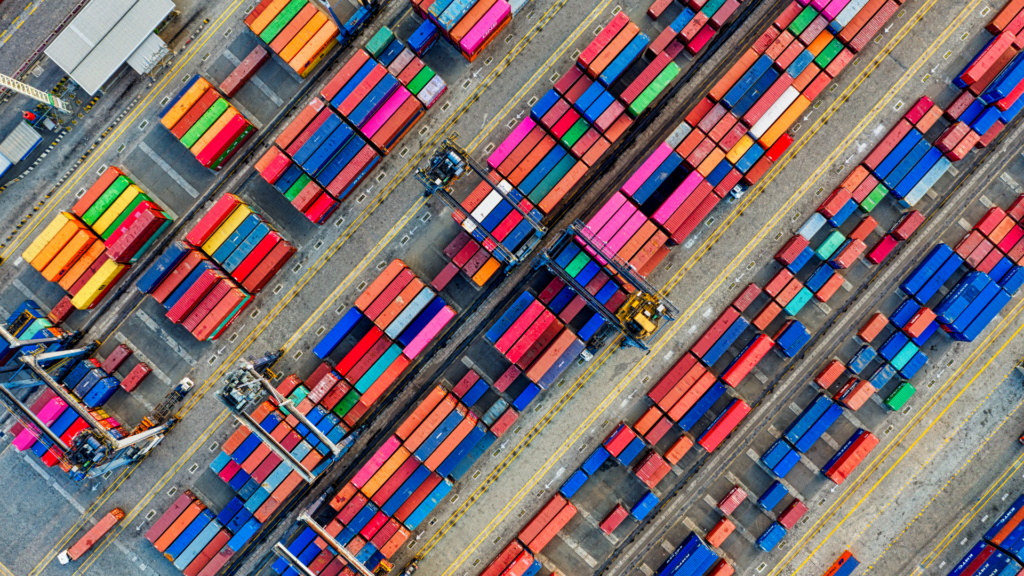

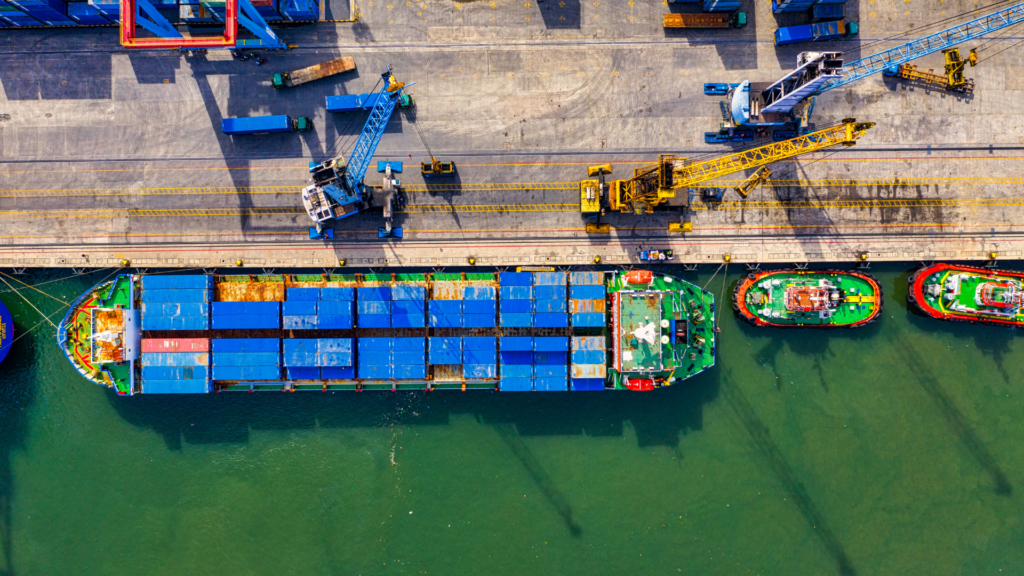

Back to Normal – For Now

After a series of major disruptions spanning the past few years, the container shipping market has finally reverted to a state of normality.

This return is marked by freight rates that continue to decline to pre-pandemic levels, as well as a reduction in bottlenecks that, while not completely eliminated, are in line with the amount experienced under normal operations.

While the supply chain is never without potential issues even in normal conditions, such as strikes, weather events, and breakdowns, the reduced tension in the industry offers shippers the opportunity to breathe a little easier than they’ve been able to since the start of the pandemic.

However, one of the most significant aspects of an event such as the pandemic is its unpredictability, so professionals in the container shipping industry should consider making preparations for future large-scale interruptions a part of their normal operations.

Between manmade and natural disasters, the industry is rife with potential for setbacks that could lead to major interruptions and significant loss. Setting portions of gains aside for the future could mean the difference between a company that weathers the storm and one that collapses under it.